Investing in Land is one of the best ways to build up cash and passive income. It’s one of the SECRET sub-niches within Real Estate Investing.

It’s been one of the main reasons we are able to branch into other business ventures and helped my wife quit her job.

There are different strategies you can enlist. I’ve found that every strategy involves being able to find property for cheap and then re-selling it for a profit.

Table of Contents

Flipping Land For Cash and Passive Income

I’ve done a number of land deals that have earned cash and owner finance deals (a.k.a. owner finance). I’ve found that you need to set up your systems right. Once you do it once, you can do it over and over again.

Our First Tiny Little Deal $39.52 Per Month Deal

The first thing we did was we bought this land for SUPER Cheap. We bought it for $0.25 cents on the dollar.

It’s important that you are able to get land for super cheap. This is the first and most important aspect of buying land as an investment.

This property was in New Mexico, but we found a similar deal in Texas as well. There is land out there that you can get for a couple hundred dollars.

For the most part, many states have places where you can find very affordable land. If you think about it, there are people that refuse to pay their property taxes even though it would be a loss of their land.

There are simply people that just don’t want their land. You can capitalize on this.

We Bought This Piece Of Land For $200

We actually got this piece of land for $200. I thought that was very cheap. I was surprised that we actually found this land.

We found that we could get even cheaper pieces of land. We would later find people that wanted to donate their property to the county.

We Got $200 Back in Our Down Payment and Document Fee

Essentially, we got our money back right at the moment of sale. We were able to get our initial investment and get monthly payments afterward.

It’s the first mindset shift for us. We need to find deals that we get our money back right away. At the very least, we need to get as close to our investment.

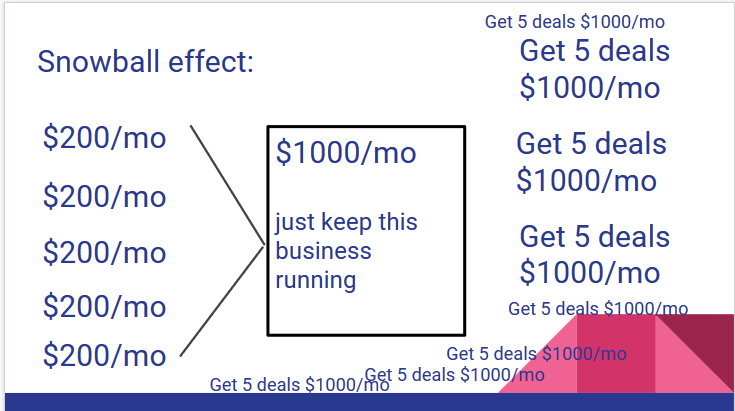

The sooner we get out money back, we can reinvest the money into more deals. This has a snowball effect.

Getting Monthly Payments For Our Owner Finance Deal

We were about to get this money for multiple years. At first, it seems like not much. As we got multiple deals, it became a sizeable amount of money.

These types of deals were what helped my wife get out of the rat race and take care of our baby. We needed to focus on the monthly payments.

How We Snow Balled the Process

We Kept Doing These Deals Over and Over Again

We got rather large cash deals and reinvested it into our business. This just meant quicker deals because of our growing inventory.

We started streamlining our process and making more deals.

We initially focused in one area, but now we are working in multiple counties. This has helped us offer different land parcels to people and different price ranges.

Hi-Jacking Dave Ramsey’s Debt Snowball Method for Land Investing

Are you familiar with Dave Ramsey’s Debt Snowball model?

It’s a simple process. You essentially start paying off the smallest debt. As you pay off your debts, you will end up have more money to pay other debts.

It ends up snowballing into a large amount of funds being allocating to paying off debt.

Essentially, we use the same process of building up our passive income streams. We get one deal, and then look at getting more deals.

As we increase the number of passive income deals, it starts snowballing into a larger amount of money.

Getting Multiple Deals that Give Recurring Revenue

You can do a one off, but recurring revenue works best with multiple deals. When you start stacking on multiple deals, you will be able to safeguard your revenue stream.

One deal might not seem like much. My average owner finance deal is around $200/mo. In the beginning, one deal doesn’t help all that much.

Some deals will be $50/mo, $100/mo, $300/mo, and $500/mo. I’ve found that it averages out to about $200/mo.

When you have 5 deals, it averages out to $1000/mo. As you get more deals, it becomes $1000/mo and then $2000/mo.

My wife was able to get out of the rat race because of owner financing multiple properties.

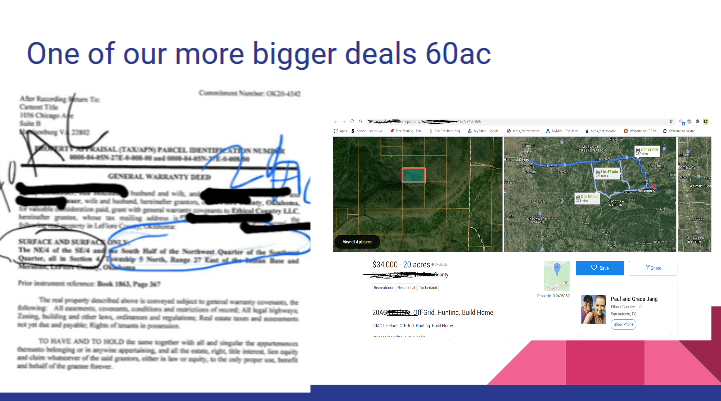

Looking at Bigger Deals Like This 60Ac Deal

We started focusing on some bigger deals. The secret was that we help the property in contract for longer till we found a buyer.

This allowed us to save our capital. When we found the right deal, we pulled the trigger in closing on the property.

This was a 40Ac and 20Ac Deal

Our 60Ac deal was actually two pieces of land. It was a 40AC and 20AC piece of land. The process to buy and sell took a couple months.

It was one of our larger deals. We essentially sold the 40AC property quickly. We got most of our cash back with the down payment. It was recurring revenue afterwards.

We then sold the 20AC not long after for more recurring revenue. One of the best things about owner financing is that we don’t have to deal with a lot of the hassles involved with typical Real Estate rentals.

We Already had a Deal for the 40AC

The systems we created helped us find a buyer really quickly. It was great to be able to find a buyer for 40AC. We had a couple different people interested in the lot.

Essentially five different land buyers went over on a weekend to check out the property. We had a lot of comments about how the area was so beautiful.

Here is a little secret between us. We never even went out to check out the property. This was totally unseen. This means that we didn’t have to go out to check out the property.

We bought the property right, so we didn’t have any real big issues come up. In real estate investing, we make money on the buy and not the sale.

We Bought A 13Ac and It Had a 4 Bedroom Cabin On It

Our biggest cash deal had a cabin on it. We usually target pieces of land to flip for cash or owner financing.

In this special case, the owner and her late husband built a cabin on the property. They used it as an off grid property to get away. Over the years, they stopped going out to the property and it wasn’t maintained.

I didn’t know about the cabin when I gave my offer. The owner told me about the cabin, and they said for a couple thousand more that I could have it.

I was floored because this property had 4 bedrooms, a well, and a place for a septic tank. All of these benefits are a great selling point.

I Never Go Out To Check Out a Property

Literally, I never go out to check property. We had some lots in New Mexico. When my wife and I did a road trip, we stopped by the area.

I actually wanted to check out our pieces of land, but never got around to it. We end up selling them without even looking at them.

In the situation with the 13Ac and Cabin, we had A LOT of inquiries on what the cabin looked like. It was so much that I decided to take a road trip to the property and take pictures.

Special Case: We Had So Many People That Wanted More Details

I actually met with the owner, which I NEVER DO. She had me follow her to the property. There were two gates that we needed to get access to.

One of the main reasons people wanted pictures was because the gates were sometimes up. When the gates were up, they couldn’t check out the property.

I think I’m pretty personable. After we checked out the property, the owners felt comfortable giving me the keys. We were in the process of closing on the property.

Took Pictures and Quickly Sold the Deal

I took a load of pictures around and making up the property. These pictures comprised of the cabin, gates, and surrounding property.

We wanted to give people access to the property so we could maximize our sales price. My wife copied the keys and started mailing them out to different people.

Profit on this land deal was $30k

Once we had the pictures, we were able to get a quick cash offer.

Our deal: We bought it for $20,000 and sold it for $50,000. It was a cool $30,000 profit. This one deal was more than half what my wife made in her job as a teacher.

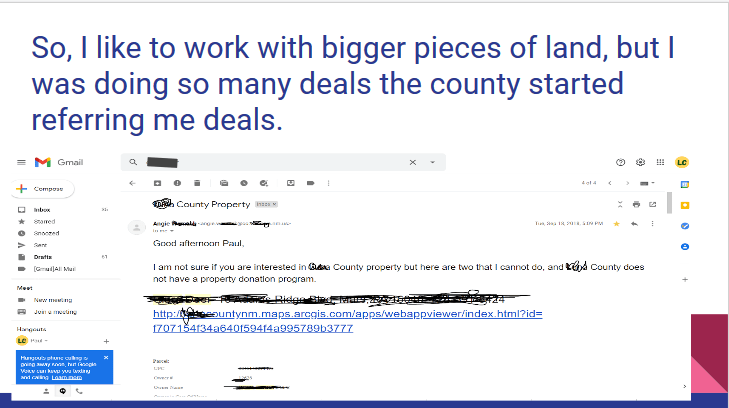

The County Started Giving Us Free Land

The County Clerks Office gets all the real estate transactions in the county. If a deed is not recorded with the County, people don’t know who owns it.

Each state has a County Clerk’s office to make sure everything is recorded properly. The Tax Assessor and Treasurer work together that they get their property taxes from the county.

I made friends with the County Clerk

So, I started doing a bunch of deals within one county. We started becoming friendly with them. They recognized us and they knew we helped people with land needs.

One particular official started sending us deals. This was a cool way to get land deals. In many cases, I was able to get these parcels of land for free.

There were people that just didn’t want to deal with paying property taxes and having the property under their name.

She sent a Couple Free Deals

Whenever the county sent us a deal, it was pretty much a guaranteed deal. They were very hot deals.

A lot of these people just wanted to donate the land to the government, and the government was refusing their offer.

Essentially the government didn’t have a process for taking these properties. I mean it makes sense, Unless the government have a use for the land, they would rather collect property taxes on them.

It was like we were doing the government and these land owners a favor for taking their land.

They wanted to donate the property, but the government wasn’t allowed to take them.

Essentially, the government wanted the property taxes. So, the official that I got friendly with started sending me all these deals.

It was pretty sweet because I wasn’t expecting them.

I would essentially flip the land for cash or sell them with owner financing. I loved getting these types of deals because there was no cost to them.

How We Used Land Investing So My Wife Quit Her Job

We started snowballing more owner finance deals. These deals were great because they gave us passive income.

We used larger cash deals to buy up more land and use on different business expenses to grow quicker.

My Wife Was A Teacher, and Got Pregnant

We actually had a three year plan on both of us quitting our jobs just from our land investing. The plan changed because my wife got pregnant.

She did not want to stay in her job. We basically focused all of our efforts in land to replace her income and keep it growing.

Baby John Meant She Didn’t Want to Go Back to Work

My wife was pretty adamant that she won’t keep working. It was basically do or die. We spent more time getting deals and getting our marketing done.

The land deals started happening because we focused our attention on this side of our business.

We focused a lot on building our the systems for our land business. We leveraged other people’s resources to speed up our business.

The Large Cash Deals Were Nice, But the Recurring Revenue Helped Her Quit

We started getting chunks of cash. It was $5,000 and then $20,000 dollar deals. We spend some of the funds on our own expenses, but we largely reinvested it into our business.

The real benefit was when we started stacking on owner financing deals. these owner financing deals started building upon one another. We started averaging about $200/mo for every deal. Some deals were lower and some deals were higher.

Over time, it got us enough recurring revenue for my wife to quit. One of the main benefits is that it takes so little time. My wife could work on the land business and take care of our baby. I just kept working on my side hustles and building up different businesses.

How We Spend Less than 1 Hour a Day In This Business Model

We have other people working to send our offers. We generally did blind offers. Essentially, we had other people printing and mailing our work.

We leveraging different tools and marketing channels to get out land sold quickly. Essentially, I would do the paperwork whenever we had a deal.

My wife would answer questions and make the sale. Overall, for every deal, we spent only a couple hours. It resulted in having large cash deals or owner finance deals that would pay us years into the future.

We Did Land Investing As A Side Hustle

There are different side hustles you can choose. Land Investing became the side hustle that we chose to get going with.

I always had an interest in Real Estate. I found that I could have the benefits of flipping houses and renting houses by investing in land.

It was actually my wife that got us to focus. I’m a little scatter-brained and try a bunch of different entrepreneurial efforts.

What is a Side Hustle?

When my wife decided to quit her job. I actually spend close to $10,000 for different courses and different side hustles. I was basically trying to see if there was another maybe better way to make money.

A side hustle is something that you can do aside from your main work.

I figured that we could actually spend time doing different things to make money. One of the main things that I found was focusing on things that work.

Once you find one that works, you should really stick to it and grow it. It’s one of the main things that I’ve learned. You can try other things, but don’t leave it to the side.

How Much Time Did We Spend on this Business Model?

Really, we spend less and less time as we built out our systems. We’ve tried a lot of different data companies, marketing channels, contracts, and other stuff to get to this point.

In actuality, figuring out these things took a long time. A lot of times, we learned different things as we pushed our business model. At this point, we spend on average 2-3 hours per deal.

Once the systems are set up and you get the plan, it’s smooth sailing.

Where Other Land Investors are Investing and Making Serious Cash

Did you know that investing in land is one of the BEST and Under-utilized real estate options?

There are a lot of investors that knock on investing in land, but it’s because they just don’t know how to make money off of it.

Three Different Secrets for Land Investing

There are three secrets to land investing. If you follow these secrets you are are able to build a real business around investing in land.

The first secret is being able to find good deals. If you can’t find deals, you can’t build a real estate investing business model. What is important is that you are able to get the funds to keep growing the business.

The second secret is that you are able to build passive income with land investing. It’s important to be able to get recurring revenue. Owner financing is one of the best ways to build passive income. By the nature of land, it’s hard to damage it. Essentially, you don’t have to deal with a lot of the hassle you might find with rentals.

The third secret is that you can build a team to do all the work for you. You can hire people from overseas to do a lot of the admin work. Each owner finance deal has averaged about $200/mo. This means that with one deal, you can fund a lot of the admin work involved with land investing.

One Thing: Land Investing Will Help You Become Financially Free and Build Wealth

Here is the thing. Land investing got my wife out of her job and stay with our baby. It’s given us multiple income streams and helped us build out other businesses. Land Investing will help you become financially free and build wealth, if you stick with it.

Our Land Investing Strategy to Make Passive Income

Owner financing land is the way to go. You can try leasing it out, but owner financing is the most reliable way to make money. After you make your deal, the money keeps coming month after month.

You can get your money back in the down payment. This allows you to scale. Because you get your money right back, you can reinvest it. When you get more deals, you will be able to scale up your owner finance deals a.k.a. passive income.

My favorite deal is buying land for $5,000. I get the land $0.25 on the dollar. This would mean that the property is worth $20,000. When you buy the land right, you are able to profit. It’s reasonable to ask for a down payment.

If you ask for $5,000 down, you still have $15,000 that you can take as payments. The best part is that you are able to charge interest fees just like the bank.

Quickly Flipping Land For a Profit

If you are able to buy right, you can sell the land for a quick profit. People are willing to pay cash for parcels of land.

You can do this with different items, but land is one of the most efficient items to flip. You can do this from home with only a computer and phone.

For almost all properties, I never go out to check out the lot in person. I generally spend very little time looking at a property because I buy the land for the right price. I use GPS coordinates to see the property and use Google Maps to look at the topography.

If it’s a larger lot, I might hire a photographer to take photos. A lot of times it’s unnecessary because people will look at multiple lots before they purchase. If you price the property to sell, you will get more inquiries than if you had brilliant pictures.

Using Cash To Fund More Passive Income Deals

One cash deal can net you $10,000. When you get these chunks of cash, you can reinvest it to get more pieces of land. Some land deals will net more chunks of cash and other deals will net you passive income.

By reinvesting into buying more land, you can scale up. This is how you start building up your cash reserves and build more passive income streams.

Secret #1: How to Ethically “Buy” Property Without Having to Personally Spend Money on the property.

Money has been one of the BIGGEST problems with real estate. I realized though that if I have a deal, we can make money off of it. People will come together and you can find a way to make it work.

Leveraging Partners

In Real Estate is takes money to purchase property and flip it for profit. Land has multiple investors looking to make money by partnering with people for a cash flip. If you can find the deal, you will bring people in.

Using Lines of Credit To Pay for Land

One of the things I didn’t like was partnering with people. The reason for it is because we would have to split the profits.

If you have a decent credit score, you can get a line of credit. Usually, you will get the best deals with a credit union. I started my line of credit with $20,000. It was enough to get going with deals.

Essentially, you can use the line of credit and pull a bunch of cash for your deal. As soon as you make you flip, you can pay back you line of credit and do it again.

Preserving Cash Until You Have a Buyer

One of the best things you can do is extend the time you have for a potential deal. When you have a potential seller, try to negotiate a longer closing time.

The script that I’ve used has resulted in almost a 90% success rate. It’s important to be personable and honest with people.

While you have the property under contract, look at finding a buyer. When you have the buyer, you can close on the property and limit the risk of tying up your money.

Secret #2: How to build passive income streams without having to deal with maintenance a.k.a tenants and other hassles.

Land Investing allows you the opportunity to build up passive income streams. This type of deal will involve owner financing.

Essentially, you become the bank for these types of deals. You collect the down payment, principal payments, interest payments, and any maintenance costs.

The Benefits of Owner Financing

Land is very different from rental properties. You don’t have to deal with repairs or the phone calls involved with typical rental properties. You don’t have to deal with the hassle that is normal with rental properties.

If someone doesn’t make a payment, you take the property back. You can then resell the land for more profit. Most bankers don’t want foreclosures because they are not in the real estate business. They don’t have the infrastructure to fix repairs and resell for higher profits.

The Unique Qualities of Land That Prevent Hassle

As a land investor, you don’t have to deal with issues with rental and mortgaged properties. If they don’t pay, you take back the property and sell it for more profits. You keep the past payments they give you just like the bank would if you defaulted on a loan.

Your operation is a blend of real estate investing and banking. It’s very hard to damage land. They can’t move it. You simply take back the property and you sell it again.

Secret #3: How to make a lot of deals without having to do more work.

You need to operate like a business. The way you make more money is by getting other people to do the work for you.

You need to have the cash flow to be able to pay people. You can use one passive income deal to pay for someone to do a lot of the admin work for you.

Leveraging the Efforts of Other People

Look at spending less time by leveraging the efforts of other people. You can hire people to do that admin work for you.

You can hire someone a couple dollars an hour to do a lot of the work for you. I’ve found some of the most resourceful work has been with people from overseas.

Any Business is About Creating Systems

A business is about creating systems that you make you money. If you aren’t building out your systems, you are essentially acting like a self-employed person.

Look at building a team to do the work for you. You can use software to help you with this process. In the end, it’s important to be able to build out the systems that will make you money.

Look At Streamlining Your Process

Land Investing can be a one time thing or a business model. At first, it can be a good way to see if this business model works.

Once you get your first cash or owner finance deal, you will be able to see how you can scale. You just keep doing the same thing and bring on people to help you with the process.

Our Land Investing Course

We’ve put together a Land Investing Business Master Package for potential land investors. You can try figuring it out yourself and waste a lot of time. There are a couple modules under to help you get started.

How we have made our Land Investing Course?

We had made our Land Investing Business Master Package by spending years and focusing on the things that mattered. There are a lot of things you can do, but there are only a few things that you need to focus on.

Some of the missing pieces that have now made up our main strategy

One of our main strategies has been trying to get our money back in every deal. By focusing on the right types of deals, you can make money without worrying about the cash.

The way we started doing this is by focusing on cash deals and the right owner finance deals. The right owner finance deal was about getting our money right from the down payment.

When we focused on these types of deals we made money. These types of deals required us to focus on buying right and selling it right. When you can’t do this, you can’t scale up.

Asking People For More Time in the Contract

One of the other things we started doing was asking for more time to close on a property. I use a script that has given me 95% closing rate. I

t’s a matter about setting up the conditions right. It you don’t set up the right pre-frames, people will say no to you.

We can have the right deal, but if it’s not set up properly you won’t be able to scale.

What we are talking about velocity. When you put out money, how long does it take to get back your money and then make profit.

Focusing On A Blend Owner Financing and Cash deals

You can control the types of deals you get by making the offers on your property. It’s based on how many offers you send out and how much you offer for the properties.

You can’t always control the type of buyers interested in the land that you have. You can’t control if they will want an owner finance deal or a cash deal.

Some people just don’t want to make payments. Other people don’t have all the cash on hand, but are highly motivated. You’ll find a blend of all sorts of people.

Look at doing both types of deal. Don’t limit yourself on the buyer, but setting up the conditions for a really good deal. As long as you get certain terms on a property, you win money.

Finding Really Good Deals Consistently

Any kind of real estate investing involves being able to find really good deals. You need to be able to do this over and over again.

There are different places to find really good deals. In general, you won’t find them on listing sites. If they are advertising it, you won’t get a good deal. You need to look at off market property.

In order to find really good deals, you need to find off market property. There are a couple ways to do this, but the best way to get deals is by sending mail. Whenever you send out mail, you will be able to get a percentage of people to respond.

Start Looking at Buying Land

You can start the process of looking at buying land to buy. I’ve specialized in rural vacant land. The steps types of land are people that want to live off grid and away from people.

Usually people look for access, large acreage, and a good price. If you have just one of these, you can have a deal. If you have more than one, it becomes extra valuable.

I look at counties surrounding major cities. You can go for properties closer to cities, but these properties have a different buyer. You will need to concern yourself with zoning and utilities. By looking at off grid properties, you can negate a lot of those other due diligence needs which ultimately save you time.

Start with Finding Really Good Deals!

You need to focus on finding really good deals. Focus on creating the system to get your lots. There are different strategies, but I recommend you look at mailers and pricing properly.

This gives you the opportunity to scale and work directly with land owners. There are a lot of land owners that are ready to take cash for a property.

Other Strategies Involve Looking At Tax Auction

Another strategy for finding really good deals is by looking at tax auctions. There are tax auction in every county. There are people that don’t pay property taxes.

When property taxes are not paid, the county has the right to sell your property or the lien to the property. Each county has different rules to tax auctions.

Essentially a tax deed state gives you the right to the property from the beginning. A tax lien state gives you the lien. If the lien is not paid, the lien holder can foreclose on the property.

These property owners are willing to let go of their property. You can find multiple deals like this. Make sure to set up your deals properly. Find these deals and you will be able to make money.

Use Direct Mail to Get Your Properties

I’ve found one of the best ways to make money is by sending direct mail. You will be able to find deals just by sending out offers and targeting the right people.

I’ve gotten 90% of deals consistently using this method. There are different ways to get deals, but you want a consistent way to find deals. Direct mail is one of the easiest and best ways to find deals. When you find deals, you are able to leverage this find into money.

Using Land Investing To Get Owner Finance Deals a.k.a. Passive Income

If you get the proper deal, you will be able to get your money back right from the down payment. The right owner finance deal, will help you scale. Scaling is what allows you to build passive income at a steady pace.

If you have the cash on hand, you can look at making money from the monthly income. You don’t have to worry so much about the down payment. It’s important to have a blend of cash and owner finance deals.

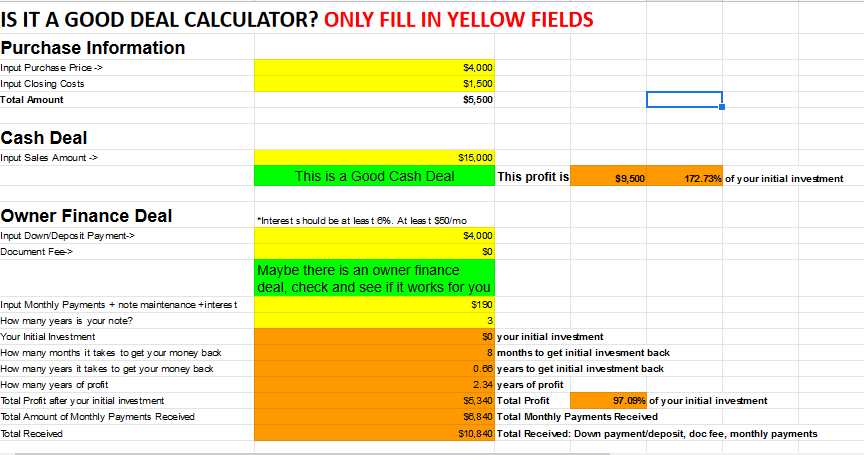

Is It a Good Deal? Calculator

Look at using a calculator to find out if you have a good deal. Essentially, you want to make sure that you make at least 100% of your initial investment.

If it’s an owner finance deal, you want to get your money right from the down payment. If this isn’t possible, you want to at least know how many months it will take to get back your initial investment.

When you have these numbers, you can know if you have a good deal or not. I will push to get a cash or an owner finance deal that gives money straight from the down payment. You will need to determine if you should pass or go forward with the deal.

Due Diligence Checker

You need to have the proper due diligence. If you don’t check on the land, you can lost a lot of money on a deal. The worse thing is having your money tied up in a piece of land that won’t sell in a timely manner.

The 3 Things That People Care About: Acreage, Access, and Price

People care about 3 things mainly that affect price. They want more acreage, access to the property, and a good price. You need at least one of these factors to sell land.

Out of these 3 things in land, the most important factor is price. You want to have a price that is attractive to other people. When someone is searching for a piece of land, they will consider the price and other similar properties. People will ALWAYS ask about price. If you have the best price, people will inquire about your land.

In terms of priority, I will choose price as the most important category. I found that access is the second most important feature. Mainly, it’s because people want to check out the property. If they check out the property, they are more likely to purchase the property.

In general, the larger the lot, the more you will be able to charge money for it. People want to have larger pieces of land to have more privacy. In general, they will be able to do more with more land.

Back Taxes to Cover

One of the main things you need to worry about is the back taxes. Most people are upfront about any back taxes to a property. It’s still your job to do all the due diligence.

A lot of times you can call the tax assessor’s office at the county and double check on the money. You will want to make sure that the back taxes are paid and current. If they are not current, you can renegotiate for that to be paid off or taken off the purchase price.

Deciding on States for Your Property

Look at states where you are able to self-close on a property. You can save $1,500 on each transaction by closing on the property yourself. Otherwise, you will need to factor these costs.

Some states require a real estate attorney for each real estate closing. You will want to make sure that this isn’t a requirement if you are looking to self-close on a property.

Marketing Traffic Hacks

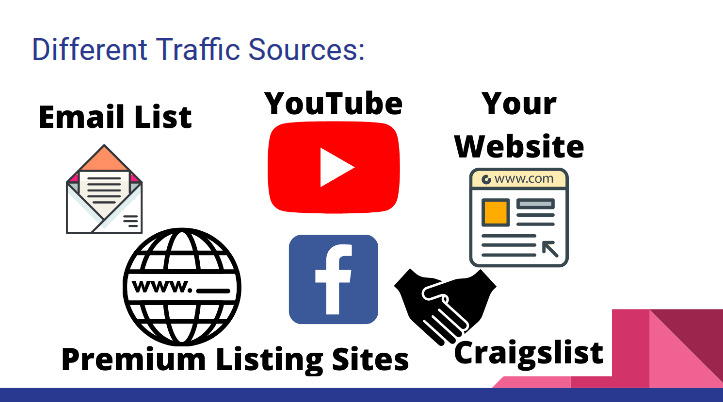

If you find a good deal, you won’t be able to make money unless you sell the property. The land investing business requires you to be able to find good deals and sell it. In other words, it’s important to be able to market the property.

Looking at Building an Email List

One of the tried and true ways to make money is by building an email list. After you get someone’s email, you are able to send them different offers over and over again.

An email list is a source of traffic that you control. If you lose access to some marketing platforms, you will be able to make money by sending your deals to your email list.

Facebook Marketplace

The Facebook Marketplace is a great way to build inquiries about the land that you own. You can put different listings about your land.

You will be able to get a lot of inquiries about your land. You will be able to generate a decent amount of traffic, but there will be a number of tire-kickers. Look at saving a copy of different texts to respond back to people.

Craigslist Real Estate Listings

Craigslist is very similar to Facebook Marketplace. I’ve found that a lot of the traffic received by Craigslist has switched over to Facebook Marketplace. Still, Craigslist generates a bunch of traffic.

Craigslist allows you the ability to generate traffic for your land deals. You will be able to find deals and it’s a free way to get traffic. You can look at posting in the nearest city and surround cities to get the most amount of traffic.

Premium Land Listing Sites

If you try finding land to buy, there are a couple land listing websites that come up. Some of the main premium land listing sites are LandWatch, Lands of America, Land and Farm, Land Flip, and Land Century.

There are different land listing sites that are starting to come to fruition. Almost all of them try to focus on Search Engine Optimization (SEO) to show up in search results. It’s common for them to look at paid advertising to get traffic to their website.

If you pay a monthly service, you will have access to their SEO and paid traffic efforts. I’ve used these sites to sell a lot of my land more recently because they are easier to maintain. Instead of having to constantly post on Craigslist or Facebook Marketplace, you can post once and get a steady flow of leads.

Team of People (VAs)

Owner finance deals give you a lot of reassurance. When you get monthly recurring revenue, you can use some of it to get some help. This helps you scale up.

Look at leveraging the efforts of a Virtual Assistant to do a lot of the admin work. You can look at having to work on posting, copy writing, social media, website, and more.

The Value of Your Time as a Land Investor

Your time is one of the most important assets. In the beginning, you might want to get your first deal to start outsourcing your work. As you get larger, you want to spend your time on the things that matter to you.

Your time is better spent making deals happen. Look at doing the research properly. Price properties correctly. You can spend $3 dollars an hour for someone overseas to do a lot of the work for you.

Using People From Overseas

One average deal is about $200 per month. You can easily use one deal to hire someone overseas to do a lot of the work for you.

I’ve hired a lot of my people from OnlineJobs.Ph. These are workers from the Philippines. The platform has a monthly payment of around $50 per month. Within this time, I will look for someone to do the work.

I’ll usually use Skype to connect with people. It’s a quick way to get a response and get to know with the potential hire. As soon as I get my hire, I will usually cancel the account.

How One Deal Can Cover Your Overseas Hire

Look at doing owner finance deals. Once you have one deal, you will be able to get at least a part time virtual assistant to do work for you.

Look at using your owner finance deals to build up passive income streams. Each deal adds on to the stack of other deals you have.

By hiring people to do admin work, you can spend your time on the parts that make you a lot of money. I’ve personally used these passive income streams to start building out other businesses.

Self Closing

Self-closing your own property will save you so much money. You can make money if you have enough margins. Closing costs have cost me on average about $1500 per deal on every transaction. Closing on your own property, can save thousands of dollars.

Having the Title Company Or Attorney Close On Properties

You can have a title company or attorney to close on properties. Some states require an attorney for real estate transactions. I would avoid these types of states.

In general, if the practice is that you use a title company for real estate transactions, you will be able to self-close on property. The best way to find out is to call your county and let them know you are purchasing land.

Ask the County Clerk how much it will cost to record a warranty deed. If they do the calculations, you know that you can do it yourself.

How Much Money You Spend On Closing Costs

If you need to spend money on closing costs, on average expect to pay around $1500. Typically this is split between the buyer and seller. I’ve found that it’s easiest to cover the expense yourself.

You’ll be able to save an additional $1500 whenever you close on the property when you buy. Just make sure to do the due diligence.

So, typically I will self-close, when the property I purchase is $5,000 or less. When the properties are inexpensive, it doesn’t make sense to pay these closing costs. I will almost always self-close whenever we sell the land to save everyone money.

How Much You Will End Up Saving When You Self Close

If you spend money on the closing costs. This can run up to $3000 in fees when you buy and sell.

When I buy a property, I will look at the deal to see if it’s worth spending money on a title company or real estate attorney. The cut off point is around $5,000 for a lot.

Whenever I sell a property, I will usually self-close. I’ve done the due diligence at this time or hired someone else to do it. Over a year, this can be tens of thousands of dollars depending on the number of deals you do.

Contracts: All The Paperwork

If you go to an attorney, you will need to draft up these paperwork. My brother-in-law had to pay about $1,000 for an attorney to draft up a contract.

Which Paperwork Will You Need

The main contracts you will need is a land contract (contract for deed), promissory note, purchase agreement when you buy, purchase agreement when you sell, mailing offer, Warranty Deed, and Special Warranty Deed.

Essentially, a land contract and promissory note allow you to lay out the terms of an owner finance deal. A purchase agreement goes over the details of the deal.

The deed is the document where you transfer over the rights of ownership. Each paperwork has a different function you need to thrive as a land investor.

What is a Land Contract or Contract For Deed?

The land contract (contract for deed) is very similar to what car dealerships do. Whenever you get financing for a car, they keep the title of the car until you pay it off. Likewise, you need to keep the title of the property until they pay it off. If not, you will need to go through a complicated and potentially expensive foreclosure process.

The land contract allows you to keep the title of the land that you own until it’s paid off. You can leverage your position in order to make sure there are no problems in the future. Make sure to have your documents in order.

Getting Your Owner Financing Paperwork Ready

You want to write out the details of your owner finance deal. Your land contract will go over the different terms. This includes the principal, interest, and down payment.

The promissory note is basically a promise that your buyer will make their payments. It’ll also go over details on what happens, if they default on the loan. It’ll go over procedures on what happens if they don’t make payments.

Funding for Your Deals

One of the main problems that I had was funding for deals. Land is inherently cheaper than residential and commercial property. Still, it can run thousands of dollars.

What Happens if You Don’t Have Money For Your Deals?

The main way I’ve been able to scale is by saving my own money. Later on, I got a little bit smarter. I focused on using a line of credit to make deals.

I realized that if you have the right deal, you can bring partners. If you have a good deal and want to partner up, you can reach out to me. There are other people around you that will partner with you.

How to Leverage Partners For Your Deals

Honestly, I’ve found finding partners to be a lot easier than I thought. I’ve found that the easiest way to find partners is to get family members involved. A lot of times, you will get some of the best rates.

You can partner with friends on different deals. If you give people the heads up, you can find funding for these deals. Just be careful on the deal and make sure it’s profitable. You don’t want to burn bridges.

Using Cash Deals To Fund Your Owner Financing Deals

After you do a cash deal, you will have money to fund your owner finance deals. These deals will give you the capital to reinvest it.

A lot of times, you will be able to get your money back quickly if you set up the proper deal. Look to get your money as soon as possible.

What are the Different Land Investing CRM Tools?

There are different CRMS you can use. I’ve found that land specific ones will cost around $150-$250 per month.

You can always use an excel sheet or a free CRM. It won’t be specific to land investing. There are problems when other users use your CRM. One delete button can erase all of your work.

Frequently Asked Questions

Should I Invest in Land or in Houses?

It depends. If you don’t have a system, look at doing houses. If you want to build a business around real estate, look at investing in land.

What are the most important things about investing in land?

Acreage, Access, and Price are the three most important factors when you invest in land.

Should I Focus On Cash Deals or Owner Finance Deals?

You should focus on both. Look at increasing your overall cash capital with cash deals. Owner Finance deals are more passive. Once you have a deal, they will pay you over and over again.

Comments are closed.