There isn’t anything inherently wrong with Tax Lien States. I just think as an investor, there are better opportunities with Tax Deed States.

Tax lien states are Alabama, Arizona, Colorado, Florida, Illinois, Indiana, Iowa, Kentucky, Maryland, Mississippi, Missouri, Montana, Nebraska, New Jersey, North Dakota, Ohio, Oklahoma, South Carolina, South Dakota, Vermont, West Virginia, and Wyoming. The District of Columbia is also a tax lien jurisdiction.

Small Business Chron

There are two other options. The state can be a tax deed state or it can be a tax deed redeemable state. I highly recommend tax deed states for investing. I don’t really recommend tax deed redeemable states.

I’ve found that one of the best assets to get for this type of investing is land. It’s usually cheaper than houses and it less competitive. If you structure your deals right, you can build up passive income through this method.

Table of Contents

What is Wrong with Tax Lien Investing?

The problem with Tax Lien Investing is that you don’t have any rights to the property itself. You are purchasing the lien. They may or may not make payments to the lien.

If they pay the lien, you get a return. If they don’t, you will need to follow foreclosure procedures.

Another option is to just go to a tax deed state auction. In these situations, you can get the deed to the property.

Read: 15 Things to Look Out for in a Tax Deed Sale

How to Get A Tax Delinquent List

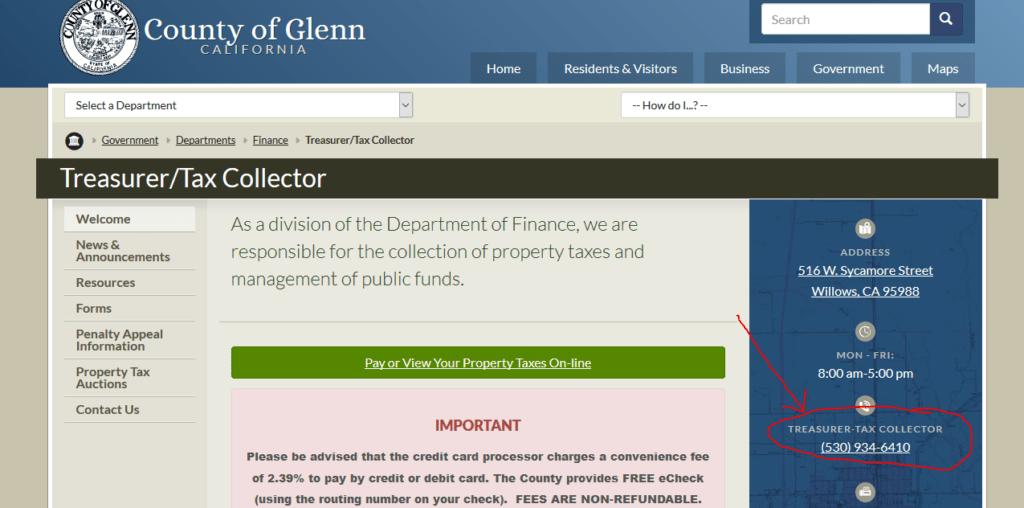

The easiest way to get a Tax Delinquent List is by calling the county. Some counties will have an online directory of properties that will be available for auction. Some of the properties may not be available during the auction because owners may have paid it off.

Do a search for the county that you want to be a part of a auction. Some places allow for online auctions and other ones require you to be at the county steps to make your bids.

Why I should invest in Tax Liens?

Tax liens are a good way to get a higher interest rate for your investment. This can be from 5% – 32%, but it almost ends in the 8-10% interest rate.

This can be nice when you compare it with other investment products. 401k plans and other vehicles can pale compare to these rates. Because you are buying the lien, the owner will generally have to pay the principal plus the interest rate. You come out winning for investing your money.

You need to build up a portfolio for this to be worth your time. You’ll also need the cash on hand to make these purchases.

Who should invest in Tax Liens?

If you have a large income, this may be a good investment for you. It can have a compounding effect. I’ve seen lawyers and accountants do really well with Tax Liens. They build up a tax lien portfolio and keep on buying tax liens.

If they have a plan in place for defaults and organizing all those liens, it may be worth checking out. This is a very active form of investing, so just be aware of the time investment it will take.

In general, it’s easier to build up your real estate empire by looking at other real estate niches. I recommend you look at getting property and leveraging partners if financing is an issue.

Why I don’t invest in Tax Liens

There are a couple things with tax liens that make it difficult. You would need to develop a CRM or tracking system. If you only have a little bit, it’s okay. You can put it on an excel sheet. You will need to track if or when a property gets paid off.

You will need to send a letter out to the owner that if they don’t pay, you will foreclose on the property. You’ll need a send a letter later on as well to make sure your investment is protected.

I’ve found it’s easier to reach out to the owners directly and get a deal that way. The best type of asset to go for is rural vacant land because it’s not as competitive. Check The Ultimate Guide To Investing In Land article.

You need to check out due diligence for any property you go for. Make sure to check the legal, access, size, utilities, and any repairs that need to be made.

You are competing with other bidders. Usually it’s for the interest rate. This means you will need to spend all this time doing due diligence, and then fight for your interest rate.

I generally will go a tax deed before I go to tax lien auction. This is because you get the property right from the beginning. This means you have your strategy right from the beginning. You know what you will need to do to make your profit.

What happens if they don’t pay it off?

Well, this just means you have a lien to a property that is in default.

Liens have an expiration date. So, you will need to make sure you foreclose on the property before the date passes.

This is an extra cost to you to get the property. Then you will need to figure out a way to sell the property. Are you going to use a Realtor?

Some of the properties just went into auction because they are bad properties. They have environmental issues or some other problem that the owner didn’t want to deal with.

Frequently Asked Questions:

Are Tax Liens a good investment?

Yes. They are better than other options. You will get a hire return for your investment. You might be able to get a property for cheaply as well.

Are Tax Liens a passive income stream?

Tax Lien Investing is not a passive income stream. You will need to keep on buying liens and replenish your liens. You’ll also need to foreclose on property at times and sell them. You can potentially hire someone do manage it for you.

Are Tax Lien Investments better than Tax Deed Investments?

Tax Deed investment are better. You get the property rights from the beginnig with a tax deed sale.