When most people think about real estate investing, they think mostly about houses. Usually they think about the fix and flip stuff that you will see on HGTV or getting into multifamily rentals.

All of these forms of investing are either time intensive or cash intensive. Sometimes, it’s both. For the beginner real estate investor, I recommend going into house hacking. It really gets your foot in the door with real estate investing. You can go into the other avenues if you have a lot of time or cash on hand.

Table of Contents

1. House Hacking

If you have never bought a house and you have a job, get into House Hacking. Basically, you buy a house using your income and you rent out the other rooms to pay for your mortgage.

This is honestly the best method for investors that don’t know what to do, but want to eventually get into some form of investing related to houses. It’s not too far out.

You don’t need private investors. You don’t need to send out mailers or solicit deals. You hire a Realtor and get a good mortgage broker. Try to find one that will give you an option to pay very little down.

If you want to know the process how I bought a house for $1500 using house hacking, click here.

2. Flipping Houses

When I am saying flipping houses, I really mean either doing a double closing or an assignment for wholesale prices. You essentially find a deal for super cheap and you sell it to a rehabber.

A lot of wholesalers will find vacant property and skip trace the property to figure out the owner. Cold calling the owners and mailers are popular ways to find deals. You can reach out to owners going through probate, foreclosures, divorce, or mechanic liens.

3. Rehabbing Houses

Rehabbing homes is what you see on HGTV. They buy a home through the MLS or off market and make repairs to the house. You will need to consider if you are going to hire a general contractor or hire out work to be done by yourself.

There are benefits to each approach and it usually involves time or money. Whatever you do, you will need to stick to a schedule for your improvements.

At this point, you have a couple options. You can sell the property on the MLS with a Realtor or you can rent it out. If you rent it out for awhile, you might be able to get a cash out refinance. Doing it this way, you may be able to get passive income and get your initial investment back.

4. Rentals

Rentals are important for a real estate investor. This is a way to get recurring revenue over time. There are a couple things to know.

You will need to be able to advertise your property to get a tenant. You will also need to manage the property. If something happens to the property, you will need to address the issue.

You can always hire a property manager, but this will cost you about 10% of the monthly rent to take those calls. You still have to pay for problems that occur to your property.

5. Subject to

A “Subject to”, or “Subject 2“, get’s a lot of praise for being a way to get inside a house with $0 Down. The reality is that you need to find these owners. This means that you will need to send out mailers or cold call the owners to potentially sell it to you.

The “subject to” is a subject to the existing mortgage. This means that you are getting ownership to the property and the mortgage is staying in the previous owner’s name.

There is usually an acceleration clause. This means that at the time of a sale, the bank can request all of the loan due. Sometimes, the bank won’t care as long as the payments are being received, but sometimes banks can ask for their loan back.

6. Owner Financing

In owner financing, the seller is giving financing to the buyer. This can be done to make an easier sale or to get a higher interest rate.

I’ve done owner finance deals mainly for land investing. It’s called a land contract or a contract for deed. Essentially, you keep the property under your own name until it’s paid off.

If there is a mortgage in place, it may be possible to do a wrap around mortgage. This means that the buyer will make monthly payments that the seller will use to pay off their mortgage. Make sure to use a lawyer in situations when there is an existing mortgage in place.

I wrote a small guide for owner financing properties that you can access by clicking here.

7. Tax Deed Sales

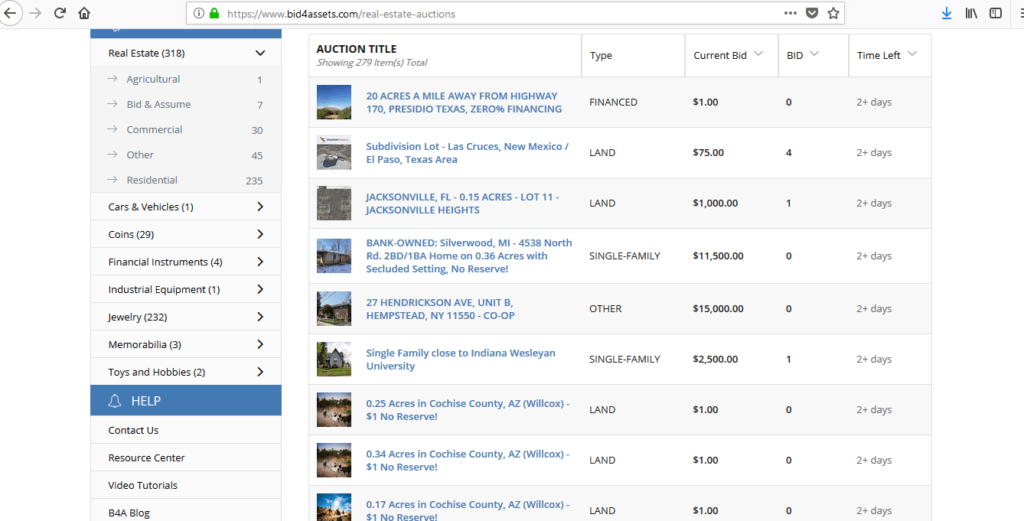

Tax deed sales are great for House or Land Flippers. They are also good for rehabbers and owner financing deals. You can think of tax deed sales as a source of potential deals. Once you get the deed to the property, you will have to decide what you want to do with the property to make money.

It’s done through an auction by the county. You will need to reach out to the county on the rules and information. I put a list of 15 things to look out for in a tax deed auction sale that you can check out by clicking here.

8. Tax Lien Sales

Tax Lien sales are done at an auction. You will need to get information from the county on the specific rules.

Some tax lien auctions are available online. Just know that the online ones are a lot more competitive. You will usually be able to get 5-10% interest on the liens that you bid on. At times the interest can be higher, but these are dependent on the other bidders and state requirements.

You will need to foreclose on the property, if they don’t make their payment. In order to protect yourself, you will need to do your due diligence.

I wrote an article about why I thought tax lien investing wasn’t that great of an option. If you are interested in know why, click here.

9. Land Flipping

I personally do land flipping and I think it’s one of the best kept secrets out there. It’s not as competitive as flipping homes, as money intensive as rehabbing homes, and it gives an opportunity to create passive income as well as chunks of cash.

I recently got a piece of land for $5,000 that I am expecting to sell for $20,000. This would be a 300% interest rate. If you do this a couple times a month, you are going to do very well.

Land Flipping for quick cash and passive income is what allowed my wife to quit her job. If you are interested in learning more about how to invest in land, click here.

10. Land Subdividing

Some land investors have specialized in this part of the business. They will buy a 200 acre lot and break them up into parts. This is called subdividing the land. They then sell them in 5Ac, 10Ac, and 20Ac to come up with massive profit.

It’s like the bartender. They buy a glass of whiskey for $100 and then charge $15 for a shot. They’ll sell a bunch of shots and come out winning.

11. Mobile/ Manufactured Homes

You can buy some seriously cheap mobile homes. Some mobile home specialist will do a little bit of work and then sell it for owner financing or for cash.

There is a growing movement of mobile homes, manufactured, and specialty homes. If you can get into one of these niches, you can find a growing market of people looking at affordable housing.

12. Apartment investing

Apartments can be incredibly profitable. There are two parts to investing in apartments. You can do it yourself or join a group in the purchase of an apartment. It just depends on your time and financial commitment.

At this level, you are looking into syndication. Syndication is when a person brings in private investors to purchase an apartment. If you are an investor, you will get a return on your investment. You will need to check on the deal and the history of the person managing the deal.

If you are the one bringing everyone together, you get the largest chunk of the profits. You just need to have a game plan and bring everyone together. This can be a great way to generate passive income or large chunks of cash.

13. Commercial Property

Apartments, warehouses, office buildings, industrial, restaurants, churches, and other properties make up commercial properties. Each type of commercial property has a different strategy associated with it. In general, you will need to focus on the type of real estate property to make money.

You will have to consider the location, function, size, condition, and leasing options to the property. It may be possible to get the rent and part of the revenue from your tenants.

If you plan on selling the property, it’s important to maximize your profit. By making improvements to the property and the overall cash flow, you will be able to charge a higher price for the property.

Frequently Asked Questions

What is the best real estate niche to build a business around?

You can do well in any real estate niche. I’ve found that land investing is one of the most under-utilized and profitable niches.

How can I buy my first house?

Start saving up money and work with a Realtor. I would look at doing a house hack and have someone pay for your mortgage.

How much money do I need to buy my first house?

For most people, you only need 3.5% down and do an FHA loan. Some states will have down payment assistance and let you get in for cheaper.