Owner financing has been around for a long time. It is a creative way to get financing for a product that you have. It’s usually used in real estate to help finance transactions. It has been used as a way to gain real wealth.

Table of Contents

What is Owner Financing?

It’s been used for a long time. Owner financing is a great option for investors and real estate agents. Generally, an attorney will have to get involved especially when dealing with a residential property that costs more than one hundred thousand dollars.

It’s a creative strategy used by real estate investors to sell property quicker. It’s also been a way to increase passive income streams and gain a lot of wealth. It has a compounding effect that can increase your yield without having to deal with the tenant issues.

My favorite way to build up passive income is by doing owner finance deals. I’ve found one of the best asset classes are in rural vacant land. Once you do one deal, you can do it over and over again.

Why Should I Consider Owner Financing as Real Estate Strategy?

The main reason that investors use this method is to sell a property quickly and for long term gain. It’s like becoming the bank. If they can find a way to recoup their investment quickly, usually with a larger down payment it can be a win-win.

For example, let’s say there is an investor. He sends out mailers or cold calls a tax delinquent list of property owners to find some great deals. Let’s say he’s able to get a dilapidated property for $25,000. It needs $50,000 in work. The property is worth $120,000 after it is fixed up. The investor buys the property.

He then puts it out on the MLS to sell for a quick turn around. It’s not selling though. He find an handyman that will buy it from him with a large down payment. The handyman offers to put $25,000 down and it sells for $65,000.

This means the investor will get monthly payments that will ultimately equate to $40,000 plus interest. Depending on the time frame, this can be a substantial amount of money.

Because the handyman got it with just a $25,000 down payment. He’s able to cash in on selling the property after it’s fixed for $120,000. It’s a win-win.

These types of deals are available to savvy real estate investors. Real estate wholesalers and rehabbers can do really well with owner financing deals.

How To Set Up An Owner Financing Deal?

The easy answer is to use an attorney or a title company. Title companies usually have some affiliation with an attorney they can use. Depending on the state you will be able to do a deed of trust or even put a mortgage on the property. This is the “official way” to do it.

Generally, a rule of thumb. The higher priced properties require more legal help. You just want to make sure things are done the right way. If you are working with a smaller property you may feel comfortable putting those documents together yourself.

Check with an attorney. They can usually draft real estate documents for you to use. Once you have the paperwork, you can use it over and over again.

Self-Closing Your Own Real Estate Deals

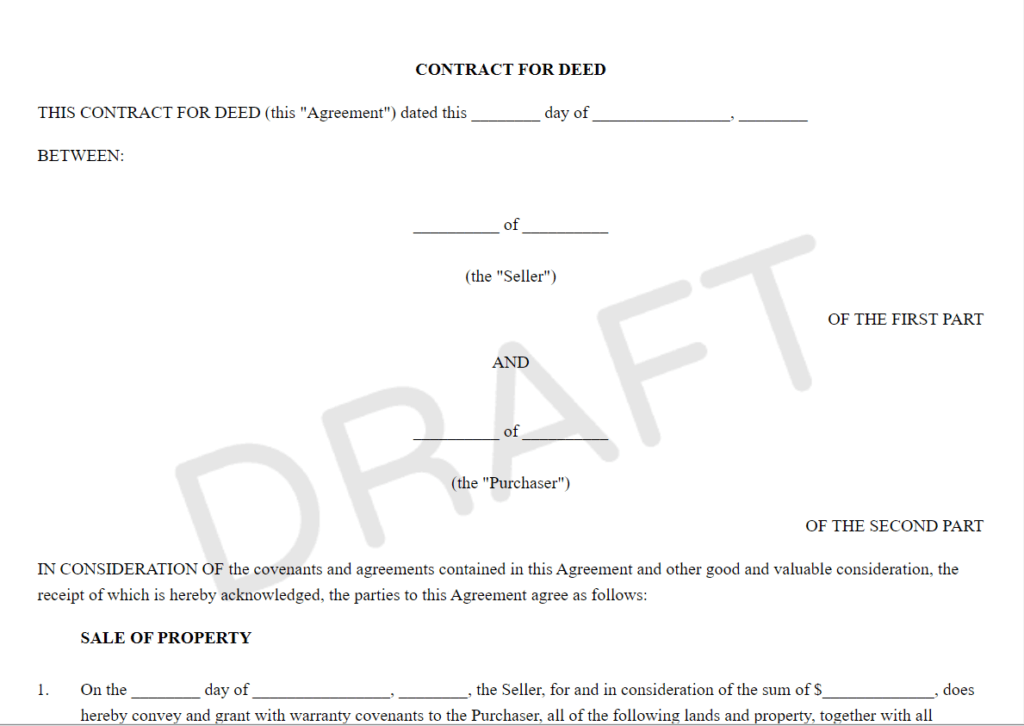

I’ve used a land contract for my dealings. Some people will call this a contract for deed. Essentially, you give the deed (ownership) of the property once the buyer pays it off.

There are a series of investors that also close on properties themselves. They record the deed and sell the property. This can be done with a land contract or a deed of contract. This is like a car dealership holding title to car until it’s fully paid for.

How much interest can I charge?

Charge as much as the buyer will accept. That’s the core principal. It’s about what the buyer will be okay with making.

Generally, if you focus on the monthly payments and the down payment you might be able to sell a property with higher interest rates. I’ve seen investors do 4% and all the way to 15%.

Double check with your state’s usury laws. There is actually a limit on how much interest you can charge an individual. I’ve found it easier to put a higher amount with a lower interest rate.

How Do I Make Money with Owner Financing?

Ideally, you want to do this multiple times. The important thing with owner financing is getting your money back. This is important to keep the process going.

If you invest in a property, you are going to need to set it up so you will get your money back from the down payment in order for you to do it again.

If you can get financing from a HELOC or private investors, you might just be able to keep going with your business. It’ll just be a matter of finding good deals and keep doing the process.

I’ve found that the easier way to compound owner financing is to do it with rural vacant land. You can get cheap property and get someone to pay the down payment of your cost, and then bring in monthly revenue after.

The Best Way To Get Into Owner Financing Deals: Land Investing

The best way to get into Owner Financing is with Rural Vacant Land. It’s the main way that my wife has been able to quit her job. Check out our Ultimate Guide to Land Investing.

On average, we get about $200 per month for every owner finance deal we do. Some deals may be less and others are for more.

You can find land deals a lot easier than with houses. Real Estate investors are able to get deals by cold calling, looking at foreclosures, tax auctions, and sending mailers.

I’ve found that I’ve been able to get a good deal a lot easier than with houses. In general, there is a lot less competition in investing in land.

The Typical Land Investing Deal With Owner Financing

A common deal is a property that I buy for $5000. I will buy the property and sell it for $20,000. The goal is to get my money back as soon as possible.

When I do this deal, I will try to get the $5000 back in a down payment. The left over amount is the principal. In this case, it will be $15,000 in future payments.

Usually, I will charge some kind of maintenance fee and interest. When you structure your deals this way, you can save your money and build up your passive income stream.

What are the Pros and Cons Of Doing Land Owner Finance Deals?

Land Deals that involve owner finance are creative ways to sell property. It doesn’t require a bank to do a credit report check and income check.

You don’t have to worry about them not paying. If they stop paying, you take back the property by giving them notice for not paying. You then sell the property to someone else.

You don’t have to worry about repairs and someone destroying your property. They can’t run away with the land.

The Pros in Doing Land Owner Finance Deals

There are definitely more Pros in doing land owner finance deals. You can generate significant passive income once you start compounding a couple deals.

- It’s more inexpensive than owner financing a house deal.

- It’s less hassle. There aren’t toilets to fix.

- There isn’t any maintenance. You just collect the payments.

- You can scale quicker because you can pull your money out quicker.

- If you need to take back the property, you don’t have to worry about repairs.

In our Land Investing Business, we’ve come to the point that my wife is able to stay home and be with our baby. She was able to quit her J.O.B. because we had that passive income coming in.

The Cons in Doing Land Owner Finance Deals

Really there aren’t too many Cons. The main problem is understanding how to do it. Once you understand how to do it, you can do it multiple times.

- You have to know how to set up your deal.

- There is a learning curve in finding the deal, marketing, and setting up the deal.

- You have to be comfortable with some paperwork.

If you are interested in partnering with us, you can join us. We run a land investing business course. If you want to help us promote it and get paid, click here.

Frequently Asked Questions

Should I Do An Owner Finance Deal?

Yes. It’s doable. Once you do it once, you will be able to do it over and over again.

What are the costs associated with doing an Owner Finance Deal?

The main cost is finding the deal. People are able to do it very inexpensively. It requires knowledge.

What is the best asset to do an Owner Finance Deal?

I believe that land is the best asset to do an owner finance deal. There are less hassles and issues with working with land. There are no repairs or maintenance.