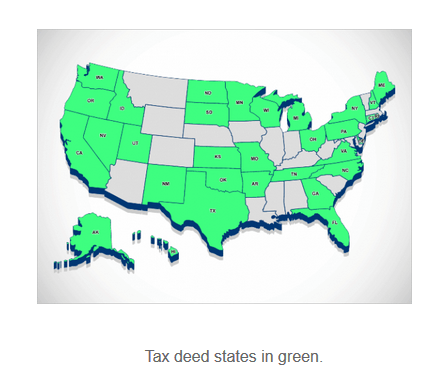

You need to do your due diligence before the sale and after the sale. This is at the heart of what you need to look for in a tax deed sale. Not all states are tax deed states. Some are tax lien states and others are tax redeemable states.

Table of Contents

1 – Figure out if you are working in a Tax Deed or Tax Lien State

Here is a list of Tax Deed States:

Tax Deed States: Alaska, Arkansas, California, Delaware, Florida, Idaho, Kansas, Maine, Michigan, Missouri, Nevada, New Hampshire, New Mexico, New York, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, South Dakota, Utah, Virginia, Washington, and Wisconsin

If you are going into a tax auction, I recommend going into a tax deed state. A Tax deed state gives you ownership rights once you win your bid.

You just want to make sure that it’s not a tax lien state. I generally don’t recommend tax lien investing. If you want to know what is wrong with tax lien investing, click here.

2 – Find out if you are working in a Tax Deed or a Tax Redeemable State

Here is a list of Tax Redeemable State:

Tax Redeemable States: Connecticut, Georgia, Hawaii, Rhode Island, Tennessee, and Texas.

You will want to know the rules for each auction. If you go into an auction in these states you need to be extra careful. You generally get the deed when you go into auction. There is a time period that the tax deed can be redeemed. This means that the owner will pay the back taxes and usually interest.

This can seriously hamper your exit strategy. Are you looking to get compound interest or are you looking to flip it for a bigger profit.

These are some of the things to think about with redeemable states:

- You will need to wait until the redeemable period is over.

- This usually means that you will pay a larger amount than a tax lien.

- You’ll be able to sell the property after the redeemable period.

- You won’t necessarily not go through the foreclosure process.

- Each property may have different redeemable periods.

3- Get the Delinquency Tax List

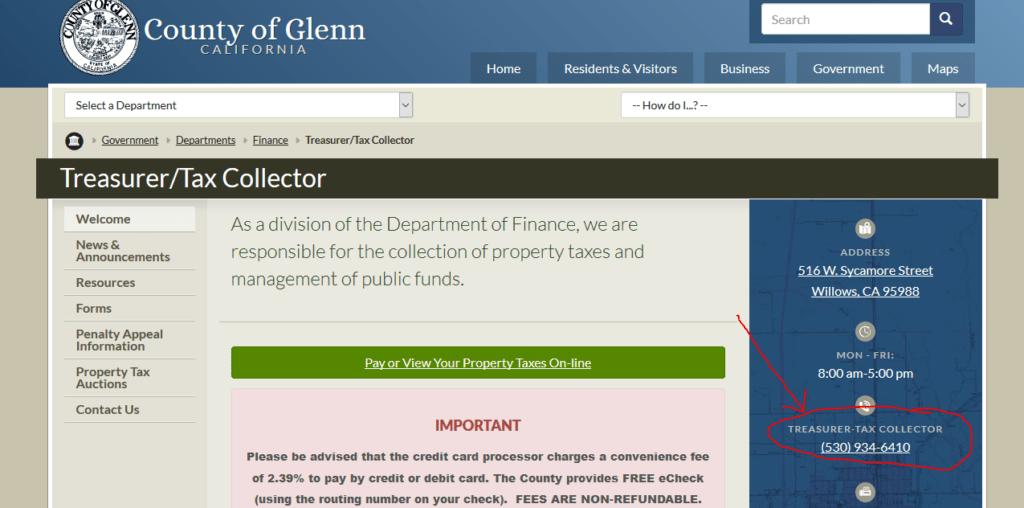

You will be able to call the county for the list. Sometimes they may have an internet site that they advertise the list on. Other places, they will send it in the newspaper.

Ask the County Treasurer or Assessor. They will usually have more information. Be aware that some of the property may not be available in the auction. The closer that you do your due diligence the better is it. Otherwise, you will be wasting a lot of your time.

4 – Find the Tax Auction Rules for the County

The tax auction rules are different for every county. Some counties require you to deposit money for the auction. Many of them will require payment on the same day.

Check when the tax auction will occur and the different expectations related to it. You should also have gotten the tax delinquent list. Ask where you can do your due diligence. They will usually refer you to the County Assessor and the County Clerk.

5 – Have Funds Ready

The counties will require you to have your money on the spot. You will need to send a wire transfer or cashier check. This money should be prepared before hand.

Some counties will require that you make a deposit before you can even participate. If they have a problem with getting the funding, they can potentially ban you.

6 – Look at the Address

You will want to double check the address on Zillow. Check what the house looks like on Zillow and look over directions on Google Maps. This can give you a decent idea on the property.

Don’t be surprised if they don’t give an address. Usually rural lots won’t have addresses associated with them.

7- Look at the Legal Description

If you are planning to invest large amount of money, you will need to look at the legal description. The legal description is how the property is truly identified. If possible you should look at the legal description. It will usually tell you where the property is located.

8 – Get the Account # / Delinquent Taxes

The account # is usually something that the county uses to reference a property. The County Assessor will usually use this to organize their database.

They will usually seek out who the owner is, who will pay the property taxes, and other related information about the property. Depending on the County, this can be a very valuable resource. At other times, you will need to look at other resources.

9 – APN (Assessor’s Parcel Number)

I didn’t really know about Assessor’s Parcel Numbers until later on. I got to know about this because I started investing in rural vacant land and they didn’t always have addresses.

This is another way to help you identify the property. Depending on your strategy, this is vital information to help you locate the property.

APN has been increasingly important for my land investment deals. I would use the APN when there is no address. It’s usually most common with land without an address.

Land Investing been the way that my wife has been able to quit her job. If you want to read about a guide on how to flip land, click here.

10- Get a Survey or Boundaries of the Property

The county will sometimes have surveys and boundaries of the property. You should be able to get it using the legal description, APN, or account number.

Ask the County Clerk for help. They have a recording of all the documents. If they have a survey or map of the are, they will be able to assist you.

If you want to hear how I lost $10,000 by not doing this, click here.

11- Figure Out Comparables

One of the most important things to do is understanding what a property is worth. If you are a Realtor or you have a relationship with a Realtor, you can ask them to give you comps on the property. The problem is that sometimes you are working with hundreds if not thousands of potential properties.

Another solution is to look at information on Zillow and Trulia for residential property. They will show what houses are selling for. In a typical appraisal, they really look at sold data. The data can be a bit skewed so take your best guess on what would be a very good selling price.

If you are looking at residential property, you will be able to look at properties by location and the price of square foot.

Price of the house / total square foot = Price per square foot

If you have a good price per square foot, you can use this information to figure out how much you should spend on a deed. Most of the time, you are buying the house without seeing inside. This means that you will need to account for rehab costs.

If you are looking at rural land, you can go Price Per Acre. It’s the same formula.

Price of land / total acres = Price per Acre

Some of the more residential property websites like Zillow and Trulia don’t have great data on land. You can check out websites like Landwatch to get a better idea.

I wrote an article about 17 places to sell your land, click here. You can use it to help you get comps and know how you can sell the land.

12 – Figure out the Cost of Improvements

If you are buying residential property. You will need to do an extra calculation on rehab costs. This can have large ranges on what you feel comfortable with. The higher your rehab costs, the less you will be able to bid on a property.

13 – Figure out your Exit Strategy

It’s important to know your exit strategy. If you are selling the property, you will need to know the time frame that you need the property to sell. Are you going to make improvements on the property? How are you going to sell the property. These are all questions that you have to ask yourself before you even submit your bid.

14 – Do You Need Quiet Title

At times, a property will need quiet title. Quiet title is when there are issues with the title. Usually for tax auctions, it doesn’t come with full warranties.

Some title companies will let you sell a property with it a tax deed. At other times, they will require you to do a quiet title to make sure that the property is fully in your name. Basically, you don’t want the previous owner to come back and try get the property back.

15 – Are You Going to use a Realtor or do FSBO?

It’s important to know how you will sell the property you got at the tax auction. Are you going to use a Realtor? This means that you will need to include commissions. This can be thousands of dollars and you will need to adjust for this.

Are you planning on doing FSBO? This means there is a possibility that the property might not sell. You’ll need to handle all the paperwork and negotiation. You’ll also need to figure out the advertising.

Frequently Asked Questions:

Are tax deed sales the best type of real estate investing?

It’s a great way to get into real estate investing. You will need to know what types of properties you will be going for in a tax deed auction. This will determine your exit strategy.

What do I need to watch out for in a tax deed auction?

You need to watch out for potential repairs, location, property type, and rules. All of these parts come together in a tax deed auction.

Read: How I lost $10,000 at a tax auction.

Are tax deed investments better than tax lien investments?

Tax deed investments are better than tax lien investments. You get the rights to the property. You can use it, rent it, or sell it.