For most 20 year olds, you’ve done college. You have a job and you are getting promoted in your field.

It’s what a lot of people do in their 20s and it’s okay. If you want to start building wealth though, you need to think a little bit differently.

You need to think of yourself as a successful and wealthy person. You need to consider what they would do in your situation.

You should look into getting into business for yourself or investing in real estate as soon as possible.

Table of Contents

The Best Strategy for Building Wealth

Serious Question: Can you Save Your Way to Wealth?

It’s honestly really difficult. If you look at people with wealth, they generally have some kind of business or own a lot of real estate.

If you want to gain wealth, you need to look at these patterns and start adjusting what you need to do to gain wealth.

Here is your strategy for Building Wealth:

- Start a business and build it up. Look to make it as passive as possible.

- Build other businesses and additional revenue streams.

- Buy real estate when you have additional capital.

The Two Ways Most People Get Wealth

There are two ways that most middle class citizens have generated wealth. It’s been in real estate and business.

If you have a job, you need to look at ways to get into business or buy up real estate.

It’s really difficult to make money with stocks and paper assets. The problem is that you have to wait a long time for these assets to make money. As soon as you sell them, you will get taxed on it.

The most wealthiest people have stocks in their business. They’ve gotten to a point in their business that they’ve made their business public and reaped the benefits.

Building Assets vs Liabilities

What are Assets?

Assets are income producing. They give you capital, leverage, and resources to purchase other items.

Some assets that you should think about are your job, real estate, paper assets, and business.

What are Liabilities?

Liabilities are income taking. If it takes money away from you, they are liabilities.

Some liabilities are mortgage payments, rent, car payments, utility payments, and subscriptions.

Why is it important to the know about Assets and Liabilities?

In order to generate wealth, you need to think about accumulating more assets. If you don’t have assets, you are not wealthy.

Having the Right Mindset

Belief The You Can Become Wealthy

Belief is the first step in becoming wealthy. If you don’t believe that you can be wealthy, you won’t be wealthy.

Most people don’t take the steps to figure out what it takes. You need to leverage your time and resources to make it happen. Most people don’t try figuring it out, and end up struggling financially.

Looking at Patterns of Success

It’s important to look at the patterns of success. Other people have become wealthy. Why can’t you?

The most successful people own businesses.

All successful people have focused on building up assets. In general, it was in business and real estate.

The people that became wealthy in real estate operated a lot like a business.

How many people saved their way to becoming wealthy? It doesn’t happen.

It’s important to budget and allocate your resources. It’s more important to start buying assets and building up a business.

Read: The Ultimate Guide: Build Multiple Streams of Income

Having a System to Follow

There are a lot of ways to get wealthy. You need to become a student and figure out the systems.

People have gotten wealthy in real estate and in business. Consider the ones that have done really well.

They have usually followed systems. You can create something innovative, but it takes time for the market to understand and find your product.

In practice, it’s easier to follow what other people have done to gain wealth.

Read: How to Get to $10,000 Per Month

What are Your Most Important Assets?

Business Income

Overtime, your most important asset should be your business. It will produce income for you over and over again.

Look at working on your business and not in your business. It’s important to think about building a system that produces income rather than working in your business.

Real Estate

Real estate is a popular asset. People have done really well with this asset class. For most citizens, it becomes their most important asset in life.

For many people, they have more equity than retirement funds. Why are people still thinking that they shouldn’t buy more real estate?

If you only bought rental properties every year, you would have enough assets to be wealthy overtime.

Read: 13 Real Estate Investing Strategies and The Best Strategy When You Are Starting Out

Licensing Rights

One of the easiest ways to get licensing rights is by writing a book. If you wrote a book, it could be licensed out to Amazon for them to market and sell.

A lot of wealthy people look into licensing products. Some businesses have done well licensing their software.

Another popular way of getting licensing rights is by franchising. If you have a business idea and built it. You can think about franchising it to other people.

Paper Assets

Paper Assets can be very lucrative. It’s difficult to buy enough stock, mutual funds, and bonds to become wealthy.

One of the best ways to build paper assets is to actually build up a start up and make it public.

If you can get jobs in these start ups, it’s a good way to get equity into a company. In general, you would require a lot more assets and it’s more common with tech positions.

If you have some leverage, you can get these types of assets. This can be some kind of knowledge, skill, time, or resources.

Developing Multiple Income Streams

Having 7 Income Streams

Most millionaires have multiple income streams. They have at least 7 income streams. If you want to get at this point, think about building more income streams.

Consider looking at these three revenue streams. I’ve found that it’s easier to have different income streams from business revenue over time.

Your Job

You job should hold you over while you build you business. There are a lot of different businesses that you can get into as a side hustle.

Consider looking at promotions and looking at positions that would free up more of your time.

Business Revenue

Build up a business that will last a long time. As you get more income, look at hiring people to help you with the work.

The more passive you make your business, the more you can leverage your time to making another business.

If you want to gain wealth, you have to get involved in some kind of active business.

You can look at local businesses, but I recommend you look at establishing an online business.

An online business will help you leverage your time and your resources. You won’t have to worry about commercial real estate, travel, and other local needs. If possible, I would look at leveraging into an online business.

Real Estate

There are many different types of industries in real estate. There are real estate agents, mortgage lenders, investors, appraisers, home inspectors, developer, and construction workers.

In general, it’s a local market. So, you will need to look at houses at maybe get involved physically.

Some people have gotten into flipping and rehabbing homes. Other people have gotten into rental properties.

If you want to focus purely on real estate, you need to do it on a larger scale to be successful.

Leveraging Your Job’s Income

Using your Job’s Income to get Assets

Look at using your job’s income to get more assets. You can have a budget for marketing or operations expenses.

As you build revenue, look at hiring more people for your business. If you have an online business, you can look at hiring virtual assistants.

Getting Promotions and a Bonus

Look at using these opportunities to expand your business or more assets. The sooner you do this, the more you can leverage it into other things.

Thinking about your Budget

Allocating Resources

Budgets are important because you need to know where your resources are going. If you check you finances, you will find a way to pull money for your business and investments.

Read: Frugal Living: Becoming Financially Free

Software for Budgeting

It doesn’t matter what software you use. Some popular software is Quicken, You Need a Budget (YNAB), and Mint.

It’s important to see where your funds are going. You can allocate your resources accordingly.

Owning a Business: A System that Generates Profit

Starting Your First Side Hustle

Look at developing your first side hustle. It’s important to think about if it’s time intensive. You will want to find a work that scales up.

For your first hustle, I recommend you look into land investing or publishing. There have room to grow and leverage your time.

Look into Land Investing if you are into Real Estate

Land investing is great because you can buy and sell land for cash. They also give you the opportunity to get into owner financing. These are two income streams that you can start generating.

I’ve found that it allows you to be able to work on it during off hours. If you want to get into houses it takes up a lot more time.

Consider rehabbing or wholesaling, if you have family members that want to do it with you. It takes a while to find the deal and monitor repairs.

Read: Land Investing: Land Flipping 101

Look into Publishing if you have some other kind of interest

If you aren’t into real estate, get into publishing. For all business types, if you don’t have traffic, you don’t have a business.

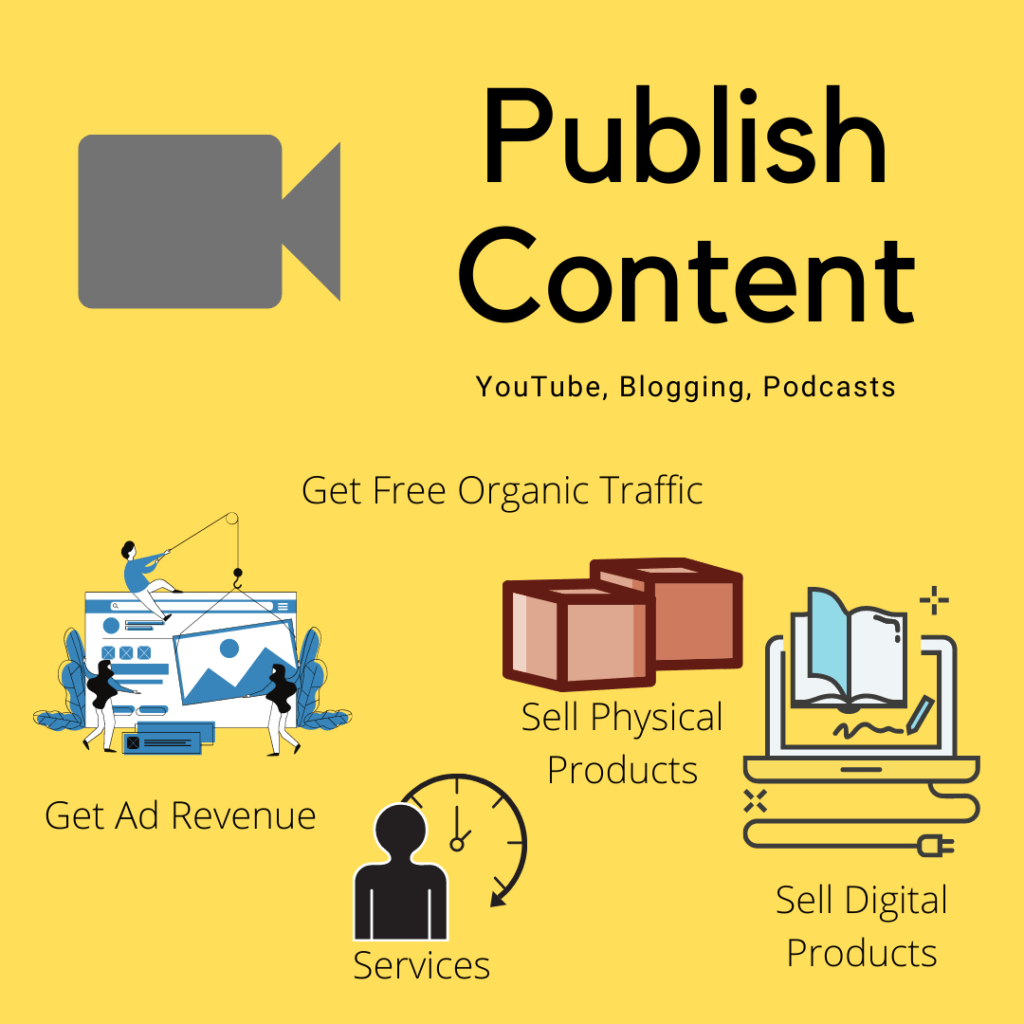

Publishing is about creating content so you can get viewers. The best places to get into publishing is through YouTube, Blogging on WordPress or Medium, or a Podcast.

Each platforms has different benefits. I would suggest you look into the platform that you use the most.

If you don’t have a preference choose WordPress or YouTube. These platforms have the most flexibility to generating multiple income streams and getting a large traffic source.

In Business: Traffic is King

If you don’t have traffic you don’t have a business. So, if you don’t get into publishing. You will have to constantly pay for your traffic.

Once you have your traffic you can create products and services that your viewers want.

In either case, each business has different risks. You will need to persevere and make your operations better to find success.

Tax Benefits of A Business

If you consider the tax system, the government tries to encourage people to give more jobs and provide more housing.

These activities help the economy overall. Our tax system is the reason that some people get upset with the wealthy when they take advantage.

Instead of blaming the wealthy, use the tax system for your advantage. Start doing the things that benefit the economy.

Writing off expenses

In order to help businesses, the government has allowed businesses to write off expenses. It helps businesses make ends meet and helps stimulate the economy.

For a person with a job, there aren’t any expenses to write off. Most if not all expenses are personal expenses.

If you have a business, any purchase made for the benefit of a business can be written off. If you have an online business and work from home, you can write off a portion of your mortgage or rent for using it as office space.

In general, the tax system is set up so businesses pay less taxes. If you don’t have a business, you don’t have these types of benefits.

The Growth and Benefits of Real Estate

Getting Your First Property

If you have a job, one of the first things you should do is buying a property. For most people, you will be able to get in a property for 3.5% down with an FHA loan.

You can negotiation all other closing costs with the seller. For some jobs, the government will also give you extra down payment assistance. Don’t worry about the interest rates as much, but look at getting into a house for as little as possible.

Look to get a house that rents well. Even if you leave the house, your rental income will cover all the expenses. This gives you the ability to move without worrying as much about the costs.

Once you have your house, you will start getting all sorts of benefits. You can rent out your rooms to help you with the mortgage. In certain areas, this will be enough to cover all your expenses.

Real estate investors call this house hacking. If you buy a multi-home or a side home, you can rent it out. In some cases, you may be able to make money.

Read: House Hacking: How I Bought A House With $1500

Tax Benefits

One of the major benefits of having real estate are the tax benefits.

You will be able to write depreciation and get tax cuts for paying your mortgage interest. Especially in the beginning, it can be really beneficial.

You will not become wealthy off of one rental property. It’s important to have the mindset of buying more rental property.

If you live in a more expensive area, look to invest in states outside your area or consider moving.

Appreciation and Rent

There are two ways to invest in real estate. It can be for appreciation or for cash flow. You can do really well with both investment strategies.

I prefer working with cash flow. Depending on your market, you may be forced into a strategy. In the beginning, I would try to make it cash flow positive.

This way it doesn’t become a liability, but it becomes an asset.

Home Equity Lines of Credit

As you or your tenant pays down the mortgage, you will be able to tap into that equity. A lot of banks will offer you A HELOC (Home Equity Line of Credit). It functions like a credit card, but you are able to make cash advances.

These lines of credit can help you with your business and investments. You can look at accelerating your growth or paying down more debts.

In either case, you have leverage your house into other ventures when you own your house.

Frequently Asked Questions:

If I have funds, should I invest in my business or in real estate?

You can get started in business with very little money. If your business requires a lot of funds, you might want to reconsider your business model especially if this is your first business.

What is more important for wealth real estate investing or building a business?

Look into building a business. If you absolutely don’t want to build a business, you have to invest heavily in rental properties. You will still have to manage and check on these properties.

When should I quit my job?

If you have a job, you aren’t using your time most effectively. You only have a job because your employer makes money off of you.

You will need to consider your obligations. When your business income is more than your expenses, it may be a good time to leave your job.